No forums found...

Site Related

Iowa State

College Sports

General - Non ISU

CF Archive

Install the app

2021 Stock Market

- Thread starter SoapyCy

- Start date

No forums found...

Site Related

Iowa State

College Sports

General - Non ISU

CF Archive

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

finally look profits on my KERN swing. in @ 4.25 out at $4.90. 317 shares. +12% to the Webull account

I don't have one particular strategy for my Roth (and maybe that is part of my problem) but one thing I've been doing is adding stocks which I think will have large capital gains in the next 20 - 30 years since I won't have to worry about paying tax on those gains.Anyone have a particular strat for profit taking in ROTH IRA? like up 10% or 15%? and selling more?

High risk/high reward biotechs (trying to find the next CELG/GILD while they are <$250M - $1B mkt. cap. or less -- $TGTX, $OMER, $BLCM) -- buyouts or bust plays.

Investing in MJ stocks like $APHA (haven't been adding of late) which could be explosive growth industries over that timespan.

Adding companies with interesting tech which I think could be multi-baggers in my lifetime ($NNDM, $NVTA, $AXON; $IAC; $CIDM) -- hold to hero/zero

Then adding companies which are paying 'fat-yields' when I bite ($PFG @ now +6% (thanks for the raise) $AVGO @ +3.5%) not all of these have worked out well as I'm bag-holding $M and looking for an exit in the near future.

I have a few other 'steady as she goes' stocks -- $MSFT, $MRK and a few 'buy the dip to flip' plays $BIIB, $BLUE -- I'd sell these plays if they advance beyond 30%.

I also have a traditional ira which was a rolled over 401(k) from previous employers, in this one I still have some biotech plays $LGND, $PRVB, $DVAX, $CLVS, $AVXL; and some 'long termers' $BNGO, $IPOE, $DKNG, $THCB, $FSLR; but I'm really trying to find deals on dividend payers which will reduce my cost basis over the long haul -- $LMT, $TGT, $BMY, $ABBV, $FIZZ

I'm not a financial advisor, I just spent a weekend in SCJ reading all the Jim Cramer books and became an autist.

I’m struggling for new ones honestly. Last year was actually easy IMO. I held gush, nail and play for the last 14 months. Tesla I bought 24k worth at 450/share and sold 60 days ago. Was a great year but mostly because you just had to hold and too many didn’tNo kidding. Apparently someone has some good intuition here lol. What's your future 20/20 on the next hot stocks?? haha.

I'm eying some, but always like hearing and sharing info.

I am just going to leave this here --

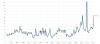

HISTORICAL S&P 500 PE RATIO

So we are back to PE ratios last seen in the Great Recession (which was probably more of an "earnings" issue than a "price" one at the time) and the technology bubble of the late 1990s and early 2000s.

Historical PEs before Greenspan were more like 15-20.

I am sure nothing is wrong and nothing bad will happen because of it.

I will note I am not predicting doom-and-gloom. Slowly deflating the above as the economy ramps back up fully and by keeping the market going "sideways" instead of up could theoretically do it.

But it's dangerous waters out there right now. A "double dip" recession is very possible.

HISTORICAL S&P 500 PE RATIO

So we are back to PE ratios last seen in the Great Recession (which was probably more of an "earnings" issue than a "price" one at the time) and the technology bubble of the late 1990s and early 2000s.

Historical PEs before Greenspan were more like 15-20.

I am sure nothing is wrong and nothing bad will happen because of it.

I will note I am not predicting doom-and-gloom. Slowly deflating the above as the economy ramps back up fully and by keeping the market going "sideways" instead of up could theoretically do it.

But it's dangerous waters out there right now. A "double dip" recession is very possible.

What impact do you think the 1.9 trillion stimulus (1400$ check round) will have?I am just going to leave this here --

HISTORICAL S&P 500 PE RATIO

View attachment 84690

So we are back to PE ratios last seen in the Great Recession (which was probably more of an "earnings" issue than a "price" one at the time) and the technology bubble of the late 1990s and early 2000s.

Historical PEs before Greenspan were more like 15-20.

I am sure nothing is wrong and nothing bad will happen because of it.

I will note I am not predicting doom-and-gloom. Slowly deflating the above as the economy ramps back up fully and by keeping the market going "sideways" instead of up could theoretically do it.

But it's dangerous waters out there right now. A "double dip" recession is very possible.

What's the safest hedge against these inflationary policies?

I created a crash watch list on Schwab. A greatest hits of sorts for great companies who dipped big during March of last year. Keeping a stash of cash ready to pounce. So many of them doubled again (back to normal value) the following year and have always been great performers.

What impact do you think the 1.9 trillion stimulus (1400$ check round) will have?

What's the safest hedge against these inflationary policies?

Real estate and commodities, probably.

Much of it varies on the amount of cash I have in the account at the time I'm buying.@frackincygy do you put a certain % in each stock or just varies?

But normally I use $$ instead of percentages (i.e. $300 'starter' on high risk plays usually), otherwise I usually try to buy to add after at least 1Q has passed (this was a lesson I learned the hard way getting in over my head on some biotechs in what was actually quite a short period of time (1-2 months)). I try to use percentages more to the sectors as a whole - i.e. limiting 'loto shots' to <20% (I'm just shy of 30 so I'm higher risk/ lower value portfolio)

If I'm selling, then I'm usually basing that on % increases - if a stock doubles (up 100%) I typically sell half my position so that my owned shares are essentially 'free'; if I have some blind luck and my position rebounds 20% - 50% in a short time I'll sell 25% - 50% to pull out some cash on my 'dumb luck'.

My real interest is in biotech plays which can have rapid swings up (and down) in a short amount of time so if shares of a company I own bounce 40%+ overnight I sell at least a handful of shares. I'm trying to get better at consolidating my positions because I just flat out have too many companies I'm trying to keep track of... plus I was just granted the ability to sell covered calls (i.e. I own 100 shares of the ticker and am 'betting' that the strike won't be reached before expiration) - have been doing this weekly with $APHA for the last month or so collecting $5-$20 / week for relatively OTM calls - it's a nice way to make some money on a non-divy stock. Plus I figure with how far out my calls typically are that if it pops that much in a week I'd be selling a chunk anyways.

Last edited:

I'd add that 'buying the dips' worked well as well. I added $LYB last spring and now have a 100% covered position on what was a +8% yielding stock at the time... that one should pay off nicely over the next 30 years.I’m struggling for new ones honestly. Last year was actually easy IMO. I held gush, nail and play for the last 14 months. Tesla I bought 24k worth at 450/share and sold 60 days ago. Was a great year but mostly because you just had to hold and too many didn’t

Yeah I think stocks are overvalued right now, but earnings will keep going up for a bit as people get vaccinated and start traveling, going to dinner, etc. I know delaying all of that has given me a lot more $$ each month to invest.

Oil stocks have had a nice pullback over the past month or so after a big run up and things didn't reopen quite as quick as was first predicted. The OXY warrants trade around $11.00 currently and should be a 5 bagger in the next five years. Or you can buy the commons and still have 3X upside in the same period.

What impact do you think the 1.9 trillion stimulus (1400$ check round) will have?

What's the safest hedge against these inflationary policies?

Energy.

What impact do you think the 1.9 trillion stimulus (1400$ check round) will have?

What's the safest hedge against these inflationary policies?

The pessimist in me says we're in the same situation we were in the late 1960s and early 1970s.

Way too much demand chasing way too little supply because of accommodating monetary and fiscal policy. All that money for NASA, the Great Society, and the Vietnam War had to be going somewhere.

When inflationary pressure hit, policymakers tolerated it/even celebrate it because they though it would mean a reduction in unemployment. But when inflation expectations caught up, unemployment went up, too, and you end up with the 1970s malaise of stagnation *and* inflation at the same time, which sunk Ford and Carter.

The only way to fix it at that point is to force a recession through higher interest rates. That kills inflation and allows the economy to "restart" and reallocate labor and capital into more useful enterprises, but that is a very painful process, as we witnessed with the pair of quick but deep recessions we had in the early 1980s.

Doing this would absolutely tank equity markets.

I suspect policymakers might want to tolerate some inflation because (1.) they think the public will tolerate it because people have forgotten how unpleasant it is and (2.) better than unemployment/recession, right? I just think it could (not that it would, obviously) get so bad on the inflation front the Fed *has* to tighten, which will cause a double-dip recession and murder the S&P 500, which means another round of horrible economic pain.

We *could* avoid this if the economy can absorb all this extra demand with adequate production and if the extra demand comes only slowly, over the course of a decade and not a year. There is some indication this could be the case given unemployment rates and capacity utilization rates for industry right now. All of what I describe above has to happen; it just depends on if it is going to be slow/controlled or quick and very painful.

The optimist in me says we can land this 747 on the aircraft carrier and catch the last arresting wire.

I am just going to leave this here --

HISTORICAL S&P 500 PE RATIO

View attachment 84690

So we are back to PE ratios last seen in the Great Recession (which was probably more of an "earnings" issue than a "price" one at the time) and the technology bubble of the late 1990s and early 2000s.

Historical PEs before Greenspan were more like 15-20.

I am sure nothing is wrong and nothing bad will happen because of it.

I will note I am not predicting doom-and-gloom. Slowly deflating the above as the economy ramps back up fully and by keeping the market going "sideways" instead of up could theoretically do it.

But it's dangerous waters out there right now. A "double dip" recession is very possible.

Because stocks compete with other asset classes, It would be interesting to see that chart with data points added for the fed funds and prime rates. Seems like things changed with the beginning of Greenspan in that the Fed became a political tool, but I think there is more to it. I don't think anyone ever imagined they would be able to keep rates pushed into the dirt for as long as they have. We seem to finally be seeing the point where that ability might be coming to an end.

IMO, technology is what's driving this...technology in investing and technology in general. In the old days, guys like Buffett spent hours poring over financial statements. Today, computers do it. Anyone in the matter of a few clicks can run a screener looking at cash flow, etc. Throw computerized trading on top of it and everything just speeds up. I think the future is going to be one where the cycles pick up speed and the extremes will be wider, and the increased level of and access to knowledge is going to increase demand and thus historical PEs. I'm not sure if we'll ever return to the pre-Greenspan era of valuations. But maybe a return of significant inflation will prove that theory wrong.

I also think we're entering another technology boom like the 90's. 5G is what is facilitating it. They're predicting a 300% increase in computer hardware in automobiles in the next 10 years.

We certainly are also seeing "irrational exuberance" again. People are buying shares of companies barely knowing what they do or how they make their money, what their balance sheets look like, and without a clue how to value them. I've seen a bunch of it just on this board. But as we learned in the 90's. this can continue for a long time before the bottom falls out. It works until it doesn't.

Because stocks compete with other asset classes, It would be interesting to see that chart with data points added for the fed funds and prime rates. Seems like things changed with the beginning of Greenspan in that the Fed became a political tool, but I think there is more to it. I don't think anyone ever imagined they would be able to keep rates pushed into the dirt for as long as they have. We seem to finally be seeing the point where that ability might be coming to an end.

IMO, technology is what's driving this...technology in investing and technology in general. In the old days, guys like Buffett spent hours poring over financial statements. Today, computers do it. Anyone in the matter of a few clicks can run a screener looking at cash flow, etc. Throw computerized trading on top of it and everything just speeds up. I think the future is going to be one where the cycles pick up speed and the extremes will be wider, and the increased level of and access to knowledge is going to increase demand and thus historical PEs. I'm not sure if we'll ever return to the pre-Greenspan era of valuations. But maybe a return of significant inflation will prove that theory wrong.

I also think we're entering another technology boom like the 90's. 5G is what is facilitating it. They're predicting a 300% increase in computer hardware in automobiles in the next 10 years.

We certainly are also seeing "irrational exuberance" again. People are buying shares of companies barely knowing what they do or how they make their money, what their balance sheets look like, and without a clue how to value them. I've seen a bunch of it just on this board. But as we learned in the 90's. this can continue for a long time before the bottom falls out. It works until it doesn't.

The 90s had BOTH of these features --

Genuinely exciting opportunities built around mass Internet access that would change basically everything about our lives. Most of the richest people in the country made their stack during this era.

Irrational exuberance and throwing a lot of good money after bad ideas that all ended badly.

I see today as similar. There are genuine opportunities out there. But there's a lot of crackpots, too. I am glad I am not in charge of figuring out which one any particular asset or equity is going to be.

I just finished reading Bad Blood on the Theranos scandal. It definitely had a 90s tech feel to it.

Technology that, if it worked, would have changed medical care forever. But it didn't work and its leaders kept lying to give themselves more time until they could but they never did and it eventually just exploded.

I feel there's a lot of that out there about now.

Last edited:

Anyone have a particular strat for profit taking in ROTH IRA? like up 10% or 15%? and selling more?

Any strategy is 100% dependent on the reason you bought it. If you bought it because the chart looked good, the strategy is going to be much different than if it was because of valuation or the future prospects of the company.

While it's good to sell to capture profits and avoid losses, as much money has been lost in the market by selling too soon and missing additional upside.

I have trades where I exit after a quick 5% run in a few days or weeks, and others I hold for years with the goal of a 300%+ return.

The ATNF train looking good on the daily chart, recovering from the failed SPAC merger and phase 3 data has all been received:I don't have one particular strategy for my Roth (and maybe that is part of my problem) but one thing I've been doing is adding stocks which I think will have large capital gains in the next 20 - 30 years since I won't have to worry about paying tax on those gains.

High risk/high reward biotechs (trying to find the next CELG/GILD while they are <$250M - $1B mkt. cap. or less -- $TGTX, $OMER, $BLCM) -- buyouts or bust plays.

Investing in MJ stocks like $APHA (haven't been adding of late) which could be explosive growth industries over that timespan.

Adding companies with interesting tech which I think could be multi-baggers in my lifetime ($NNDM, $NVTA, $AXON; $IAC; $CIDM) -- hold to hero/zero

Then adding companies which are paying 'fat-yields' when I bite ($PFG @ now +6% (thanks for the raise) $AVGO @ +3.5%) not all of these have worked out well as I'm bag-holding $M and looking for an exit in the near future.

I have a few other 'steady as she goes' stocks -- $MSFT, $MRK and a few 'buy the dip to flip' plays $BIIB, $BLUE -- I'd sell these plays if they advance beyond 30%.

I also have a traditional ira which was a rolled over 401(k) from previous employers, in this one I still have some biotech plays $LGND, $PRVB, $DVAX, $CLVS, $AVXL; and some 'long termers' $BNGO, $IPOE, $DKNG, $THCB, $FSLR; but I'm really trying to find deals on dividend payers which will reduce my cost basis over the long haul -- $LMT, $TGT, $BMY, $ABBV, $FIZZ

I'm not a financial advisor, I just spent a weekend in SCJ reading all the Jim Cramer books and became an autist.

Fed just announced as is sitting on it's hands. Says inflation is "transitory". It's all good till it ain't no good.

![seems_a_little_crazy_weird_al[1].gif seems_a_little_crazy_weird_al[1].gif](https://cyclonefanatic.com/forum/data/attachments/59/59638-6d10d9e1fa1d4a176269c6d7bb6f74e6.jpg)