No forums found...

Site Related

Iowa State

College Sports

General - Non ISU

CF Archive

Install the app

Median boomer retirement account $144,000

- Thread starter SoapyCy

- Start date

No forums found...

Site Related

Iowa State

College Sports

General - Non ISU

CF Archive

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

There is a good Frontline episode about this on PBS, and the underfunding of public pensions. The state they looked at was Kentucky, which has the worst funding program in the country. They pointed out for years, the employee made their payments into the system, but the state unfunded their share of the program. As the returns started to drop, they moved more of their investments from more secure funds into risker funds to make up the difference. When those funds did not preform as they had hoped they were caught where they are now. Totally underfunded, the GOP governor tried to get the state house to switch over the program to a 401K type of program and they refused to do. I will say, he is the first governor from the state to fully fund the program in decades.

Right now IPERS is considered to be in good shape, but they have not given cost of living increases for those retired for at least 3 to 5 years. They also increase the percent the employee pays into the system maybe 5 years ago.

personally I think they need to kill the gaming of IPERS. This using the high 3-5 years allows some opportunity to work it. Should be based off lifetime average. Take the normal person and calculate the 60% deal over the five years and divide that by the lifetime to see what percent would be truer. May be even 100% of lifetime average. Known several people who found ways to significantly bump their last 3-5 years to end up with close to their wage 5 years ago from IPERS.

If an employer does that, somebody goes to jail for fraud. Taking money out of a pension and using it for your own little projects is embezzlement.

Maybe some politicians should.

I agree but that is what they did in these states are underfunded, and you can't throw a state legislature or governor in jail over this. The federal govenment did the same thing in the 60's and 70's to SS. The took money out, the fund had a surplus, to fight the war in Vietnam instead of raising taxes.

When the baby boomers, the largest subgroup age bracket wise started to retire, they quickly found that they were going to be paying out more than coming in quickly. So they increased the retirement age and cut benefits if you started to draw at 62. Sending the problem down the road, for the next guy to deal with. when the easiest way would have been to take the lid off the top, tax every dollar earned as SS, and then capped the amount that a person could draw out on the back end.

But doing that would piss off their wealthy donors, so they screwed the little guy.

Last edited:

I may be confused, but in Iowa, doesn’t the school district put the other portion in?

I think they do in Iowa, but other states must have a different set up for those public employees. Maybe the local police department give the number of officers and their salaries to the state, and then the state pays the money into the fund.

Or it could be that the local school or city paid the funds into the state, and then the state turned around and "borrowed' money from the fund, without paying it back at a later date.

I think they do in Iowa, but other states must have a different set up for those public employees. Maybe the local police department give the number of officers and their salaries to the state, and then the state pays the money into the fund.

Or it could be that the local school or city paid the funds into the state, and then the state turned around and "borrowed' money from the fund, without paying it back at a later date.

Was certain the local school had it in their budget. It’s even worse if the take it out of the school funds it.

personally I think they need to kill the gaming of IPERS. This using the high 3-5 years allows some opportunity to work it. Should be based off lifetime average. Take the normal person and calculate the 60% deal over the five years and divide that by the lifetime to see what percent would be truer. May be even 100% of lifetime average. Known several people who found ways to significantly bump their last 3-5 years to end up with close to their wage 5 years ago from IPERS.

The gaming of the system has been a problem in the past, I know of one former supt. of mine that was caught doing it after he left our district and move to another. Its less of a problem to day.

The biggest drain on the current system is when they took the cap off the system 20 years ago. Before then a person was limited to the amount they could draw out of the system each month. With a cap off, they got the full 60% of their salaries, which started to drain the system.

I have always wondered since the coaches at state universities are public employees are they going to be able to draw 60% of their salaries when they retire? So does Bill Fennily get 60% of his salary when he retires if he has 30 years into the system. His current salary is around a million a year.

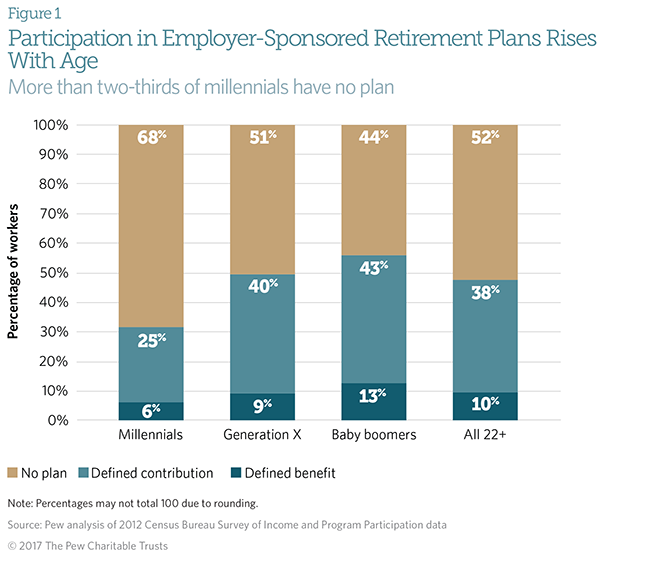

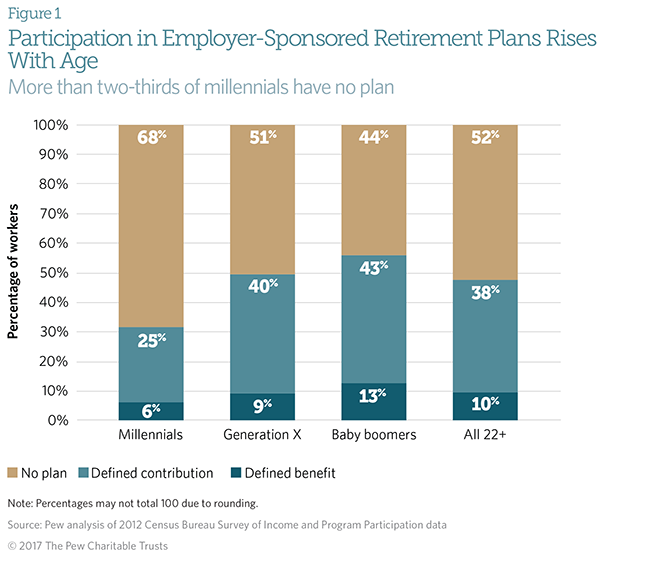

This is the winner. That generation still had pensions, which would not be included in those figures.A lot of Boomers are also going to benefit from company paid pensions.

I play it conservative and do 5%. I assume an 8% return, and back out 3% for inflation and fees.What is everyone using for assumptions when calculating their estimates? The calc I used assumed a 7% return.

I haven’t gone too overboard saving up until this point to say the least but at 6% with a 3.5% match, I’m looking at about 1.85MM assuming 7% return and a 2% raise. I feel like that’s probably pretty borderline that far out but who knows. A lot can happen over 30 years.

“Boomer” here. Only people I know that are my age with pensions are either government or union. Pensions in private sector for nonunion are not common at all.This is the winner. That generation still had pensions, which would not be included in those figures.

I don’t really intend to retire because I don’t know what I would do. I might retire from my career and do something else though. I just don’t get the appeal of retirement. My grandparents have been retired pretty much my entire life. They don’t really seem to do anything either. It just isn’t appealing to me.

My grandparents basically played cards and did the daily coffee thing and were very social locally. That was pretty much retirement. They hosted lots of family gatherings as well. Not much travel at all.

My grandparents basically played cards and did the daily coffee thing and were very social locally. That was pretty much retirement. They hosted lots of family gatherings as well. Not much travel at all.

Lots of seniors live on modest fixed income. Simple living. Low cost entertainment. Limited excursions. Their lives revolve around doctor appointments and health issues mostly. Travel is just too hard to do when you get old. And many seniors don’t have the money.

“Boomer” here. Only people I know that are my age with pensions are either government or union. Pensions in private sector for nonunion are not common at all.

when we were going through my boomer parent's estate a few years back my dad has two pensions from two private companies and my mom has a pension from the nursing company she worked for. two boomers - three active pensions from three private companies.

when we were going through my boomer parent's estate a few years back my dad has two pensions from two private companies and my mom has a pension from the nursing company she worked for. two boomers - three active pensions from three private companies.

Were they members of a Union?

Were they members of a Union?

i am assuming my mom was as a nurse but my dad was management so i would doubt that,

Were they members of a Union?

I wouldn’t call private sector DB plans as uncommon or common, but definitely skews to uncommon and the floodgates have opened for companies terminating their DB plans in the past 3 years.

i am assuming my mom was as a nurse but my dad was management so i would doubt that,

Pensions are something that most private sector employees will not get going forward. Your parents are an exception.

Last edited:

Pensions are something that most private sector employees will get going forward. Your parents are an exception.

wat

My non-union management dad worked (in Iowa) for a large company for 20 years and got pension starting at age 59.5

(Not saying that's normal or abnormal, just his case)

(Not saying that's normal or abnormal, just his case)

my post was in response to someone else saying they, as a boomer, dont know many people outside of unions without a pension. i was just saying my boomer parents have some, and yes, i am aware they rarely exist now.Pensions are something that most private sector employees will get going forward. Your parents are an exception.

It is rare even for Boomers (and becoming rarer) over time.

I found out my wife qualifies for DB pension through her fellowship as an employee of her hospital, which is a nice bonus, but she is only likely to be 20% or 40% vested (depending on when exactly "three years" hits) before she leaves it.

I found out my wife qualifies for DB pension through her fellowship as an employee of her hospital, which is a nice bonus, but she is only likely to be 20% or 40% vested (depending on when exactly "three years" hits) before she leaves it.

- Status

- Not open for further replies.