This thread is long, and there are some good observations along with a lot of drek. Not going to opine on cutting programs (which may or may not be wise, depending). But one thing I would add here is that there imho the single biggest cause driving up costs is, ironically, an effort to make college more affordable.

Federal student loans.

Throwing money at the problem in this way creates 2 perverse incentives:

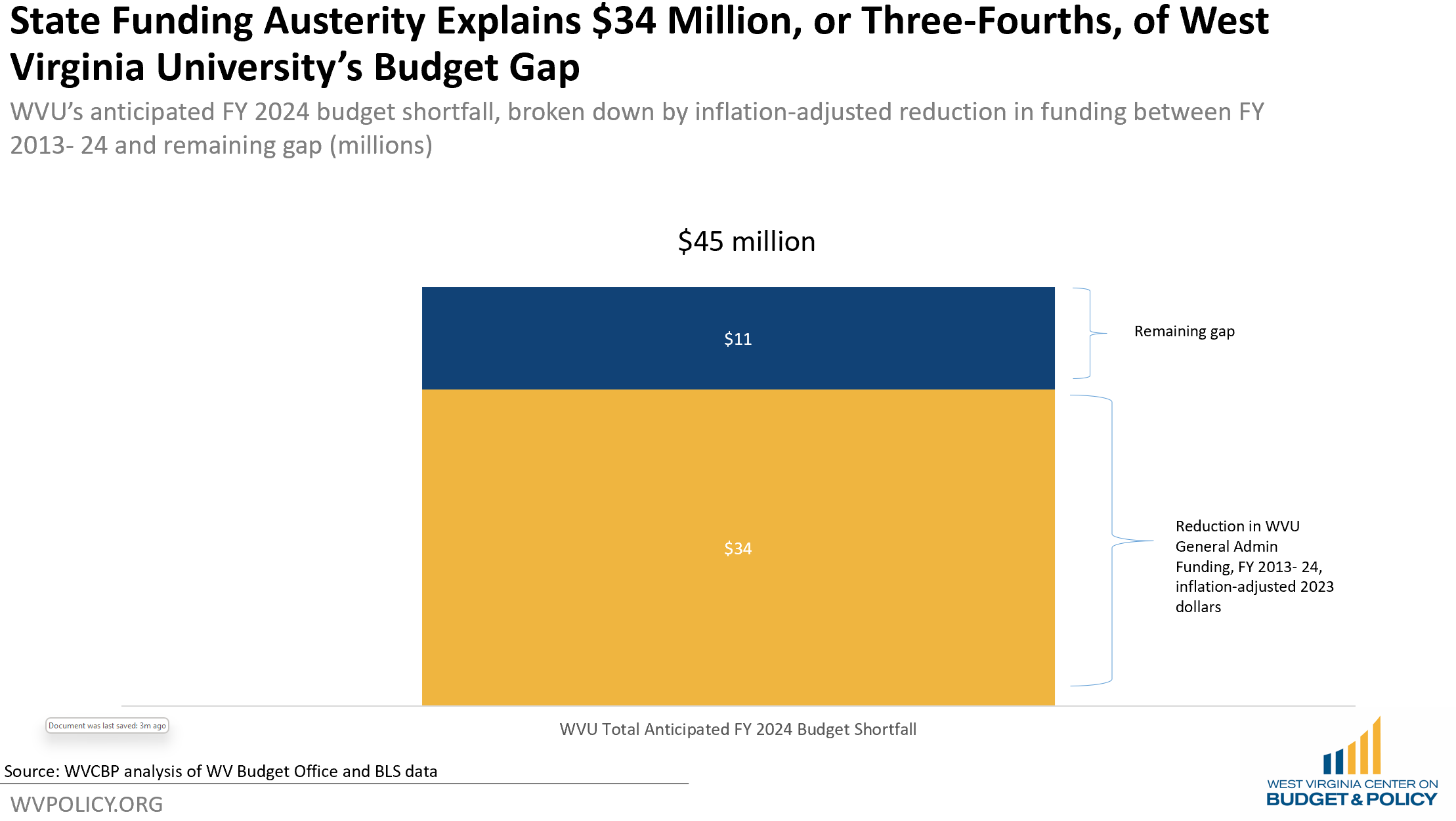

1) the state can cut funding and just let the feds give money to kids that in turn comes to the schools in state

2) the colleges can raise prices a lot because the students don't really care since payback is years away

Both of these in turn raise the overall cost to students. And the students are still on the hook for the cost - plus interest.

I struggled to find good data on student loan volumes, but here is one:

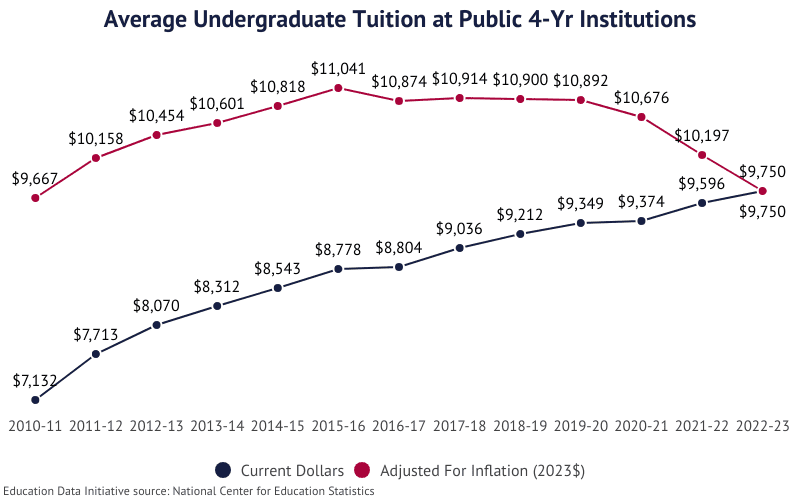

from 1995 to 2017 student debt increased from $187B to $1.4T. That's a 750% increase in 22 years (~10% annual, way more than inflation). Think that may have something to do with why college costs are also way above inflation.

You could argue that rising costs drive the loan amounts, but I truly think that is backwards. Think about it this way - if the feds ended student loan programs tomorrow, what would happen (after all the panic and angst that is)? Colleges would immediately look for ways to reduce and contain costs, so they could reduce charges to student to make sure they have enough students to cover those costs. Students would also immediately become a lot more price sensitive. The state would be forced to try to find more money for schools too.

I am not advocating ending all student loans, to be clear. Although some reductions/restrictions would be good (like don't let kids bury themselves with $100k debt for a lousy degree- make them do an ROI at least).

But how about this-- the Feds like to tie strings to money, so make it that only colleges that keep costs at or near core inflation are eligible for student loan funds. That would also incent the state to put more money in to lower costs, to leverage the federal money. Maybe I have not 100% thought this thru, but seems like that would create better incentives related to cost.

The current state is the feds write blank checks and we all wonder why both costs and student debt are going up.