Money on the sidelines? Why would anyone have money on the sidelines at this point? Seems too late to buy already.

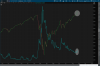

Most people aren't savy investors. When $h** hits the fan. They start hoarding cash. US savings rate was over 3x higher than normal and remains about 2x higher than "normal"

Personal Saving Rate

Graph and download economic data for Personal Saving Rate (PSAVERT) from Jan 1959 to Nov 2023 about savings, personal, rate, and USA.

fred.stlouisfed.org

Plus most households got stimulus money with more likely coming.