No forums found...

Site Related

Iowa State

College Sports

General - Non ISU

CF Archive

Install the app

.

- Thread starter SoapyCy

- Start date

No forums found...

Site Related

Iowa State

College Sports

General - Non ISU

CF Archive

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Markets Insider - Business Insider: Robinhood traders are not behind the market's recent rally, Barclays says.

https://markets.businessinsider.com...-recent-rally-barclays-says-2020-6-1029304812

https://markets.businessinsider.com...-recent-rally-barclays-says-2020-6-1029304812

I don't know how any financial services firms are making money rn.FOMO is strong right now, and is the thing keeping air in this bubble. Q2 earnings calls should smash that optimism.

Markets Insider - Business Insider: Robinhood traders are not behind the market's recent rally, Barclays says.

https://markets.businessinsider.com...-recent-rally-barclays-says-2020-6-1029304812

Honesty, these crazy pre-market moves are getting tiresome. I’m not entirely innocent here, but I think the big money players are bidding the pre-market up knowing that the new comers (Robinhood Davy Day Traders) will see the pre-market moves and once 9:30am hits they rush in and try to rise the quick rip.

I’m not hating the game here but I think it’s the big money guys that are actually playing the Robinhooders that just can’t fight the opening bell fomo.

I was pretty heavy into crypto 2017-2018. A lot of new guys gained a lot but lost everything within a half year. Sort of feels similar.

Honesty, these crazy pre-market moves are getting tiresome. I’m not entirely innocent here, but I think the big money players are bidding the pre-market up knowing that the new comers (Robinhood Davy Day Traders) will see the pre-market moves and once 9:30am hits they rush in and try to rise the quick rip.

I’m not hating the game here but I think it’s the big money guys that are actually playing the Robinhooders that just can’t fight the opening bell fomo.

I was pretty heavy into crypto 2017-2018. A lot of new guys gained a lot but lost everything within a half year. Sort of feels similar.

Crypto was gambling as there's really no true underlying value. These prices may crash again but there is still value in most companies with tangible products

Crypto was gambling as there's really no true underlying value. These prices may crash again but there is still value in most companies with tangible products

I 100% agree. I was sort of a John come lately to crypto and it did not end good, ha!

Is crypto still a thing?

I don’t really know much about where crypto stands anymore in relation to any tangible benefits.

I was just living down in Austin, TX for a few years 2016-2018 and it was quite the rage down there being Austin is a mini Silicon Valley. Sort of got caught up in it a little.

side note - if anybody ever gets down to Austin for a game, the ISU Austin Alumni group are super cool and inviting!!

Markets Insider - Business Insider: Robinhood traders are not behind the market's recent rally, Barclays says.

https://markets.businessinsider.com...-recent-rally-barclays-says-2020-6-1029304812

Nobody ever claimed they were behind the whole stock market rally. They are looking at the wrong things. They have been driving the rally in some cheap and really beaten down stocks.

"The analysis found that in aggregate, there is no clear relationship between Robinhood customers adding shares and S&P 500 index performance, "

Nobody ever claimed they were behind the whole stock market rally. They are looking at the wrong things. They have been driving the rally in some cheap and really beaten down stocks.

"The analysis found that in aggregate, there is no clear relationship between Robinhood customers adding shares and S&P 500 index performance, "

Well, not really their fault but they have been the driver. I'm afraid that Barstool sports is going to look like the real face of this faux rally. I watched him go on Fast Money a few times (I thought he was mostly just looking for a story / joke) but he threw all kinds of money in and well, was not a good trader. What has been interesting is that the little guys have never had enough pull to actually make any difference. So where is the real money/depth? That indicates the real problems are much deeper and there is NO liquidity. All the trading floors closed up and let algo's trade.

https://www.marketwatch.com/story/w...s-the-easiest-game-ive-ever-played-2020-06-09

This is why I really worry about Robinhood. The brokerage itself appears to have very little either morals or knowledge of the markets. Pushing people or letting people have margin accounts and trading options (such as selling naked options) should NEVER be allowed. Especially to new investors.

https://www.zerohedge.com/markets/f...r-family-tragedy-should-be-lesson-all-margind

And this article outlines how they have had outsized influence on the market. Namely HFT's have been front running (which means they jump in and buy first) all of the Robbinhood orders. It's clear that this guy is very emotional but that makes trading stocks almost impossible long term.

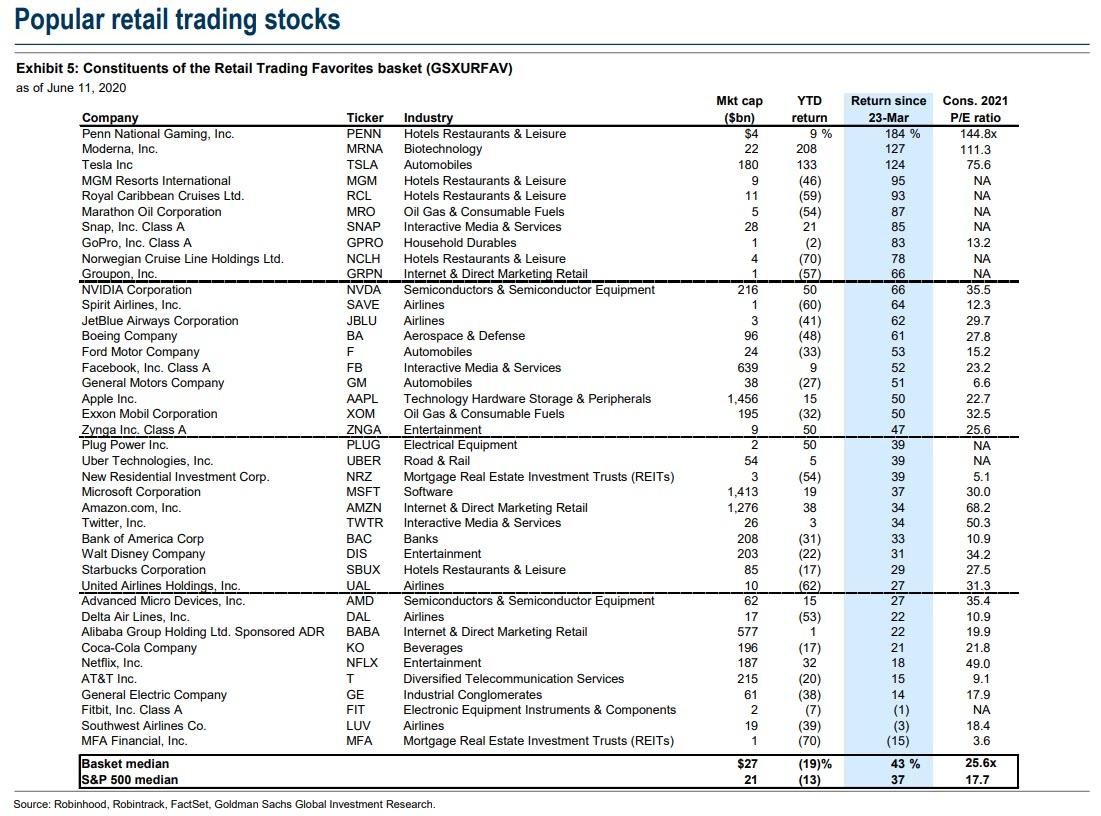

https://www.zerohedge.com/markets/d...top-40-stocks-top-performing-retail-favorites

https://www.zerohedge.com/markets/f...r-family-tragedy-should-be-lesson-all-margind

And this article outlines how they have had outsized influence on the market. Namely HFT's have been front running (which means they jump in and buy first) all of the Robbinhood orders. It's clear that this guy is very emotional but that makes trading stocks almost impossible long term.

https://www.zerohedge.com/markets/d...top-40-stocks-top-performing-retail-favorites

Regarding the Robinhood margin story, i don't know how much i believe the details there. At my brokerage your margin can only be 2x your account value, so to lose $700,000 you'd need at least $350,000 in securities, plus you'd be paying interest on that massive loan.

I made a boatload of cash trading MFA and XSPA. i told myself i wasn't going to trade anymore (only buy and hold) but the temptation was too great. i'm still down for the year on my trades but these two stocks brought back about 75% of my losses. Here's why i don['t trust people who talk about stock market gains: i say i made $15,000 on XSPA but i leave out that i lost $20,000 on Boeing and Tesla.

I made a boatload of cash trading MFA and XSPA. i told myself i wasn't going to trade anymore (only buy and hold) but the temptation was too great. i'm still down for the year on my trades but these two stocks brought back about 75% of my losses. Here's why i don['t trust people who talk about stock market gains: i say i made $15,000 on XSPA but i leave out that i lost $20,000 on Boeing and Tesla.

Where in the heck do you guys find these obscure stocks? Horrible looking stock that just had a 1 for 3 reverse split. Not sure how you make any money on that unless you are short. Did they really gun this stock because it was going to do a reverse split? This is not investing but highly speculative gambling. Which is fine as long as you realize that fact.

The Robinhood story is bothersome, but I can't verify the details. Any responsible broker limits margin and trading in these highly leveraged things for their OWN good. If this story is true then Robinhood is on the hook for a huge loss. It would be pretty easy to rack up those gains/losses say for instance in the options market. But this is why I worry that Robbinhood is doing things that it shouldn't and allowing margin/spec trading FAR beyond a normal broker.

The Robinhood story is bothersome, but I can't verify the details. Any responsible broker limits margin and trading in these highly leveraged things for their OWN good. If this story is true then Robinhood is on the hook for a huge loss. It would be pretty easy to rack up those gains/losses say for instance in the options market. But this is why I worry that Robbinhood is doing things that it shouldn't and allowing margin/spec trading FAR beyond a normal broker.

Where in the heck do you guys find these obscure stocks? Horrible looking stock that just had a 1 for 3 reverse split. Not sure how you make any money on that unless you are short. Did they really gun this stock because it was going to do a reverse split? This is not investing but highly speculative gambling. Which is fine as long as you realize that fact.

Look for cheap stocks under a dollar. The moment has likely passed after the past few weeks, but I bought XSPA under $1 and sold it at about $1.80 pre-split. I bought 25,000 shares of MFA for about $1.50 and sold 22,500 of them $2.50.

It's gambling, not investing, you're right.

The flip side is the $20,000 loss on Boeing (should have held onto it) and shorting Tesla for a huge loss. I'm about $10,000 down from where I should be but the last two weeks have really helped me out. I realized it's not healthy so I cashed in everything except 2,500 shares of MFA and put it all into VTI and VXUS.

A buddy liked XSPA so I bought a lot of shares in it (not near the amount I'm assuming you did) at 37 cents. Got up to 65 cents and stayed in that area for awhile and I got bored and sold. Seeing that it's now at $5.40 really sucks but that's just part of it I supposeLook for cheap stocks under a dollar. The moment has likely passed after the past few weeks, but I bought XSPA under $1 and sold it at about $1.80 pre-split. I bought 25,000 shares of MFA for about $1.50 and sold 22,500 of them $2.50.

It's gambling, not investing, you're right.

The flip side is the $20,000 loss on Boeing (should have held onto it) and shorting Tesla for a huge loss. I'm about $10,000 down from where I should be but the last two weeks have really helped me out. I realized it's not healthy so I cashed in everything except 2,500 shares of MFA and put it all into VTI and VXUS.

A buddy liked XSPA so I bought a lot of shares in it (not near the amount I'm assuming you did) at 37 cents. Got up to 65 cents and stayed in that area for awhile and I got bored and sold. Seeing that it's now at $5.40 really sucks but that's just part of it I suppose

I would buy sub-$2 stocks in 10,000 share blocks. Each penny is a $100 move and in march i got absolutely burned. Like, horrible, awful, soul-searching burned. I took most of what little I had left and put it into 60% VTI and 40% VXUS and called it quits. I still had about $10,000 in ny account and figured "what the hell" and bought XSPA and ended up making all but $10,000 of my losses back. Which I then promptly withdrew and put into VTI and VXUS. It's boring, not fun, the moves are really low, (whereas watching a stock get you $2,000 in 5 minutes is exciting) but it's just better overall. The pain I felt over my bad bets was awful and I don't want to take that risk anymore. So I closed my margin and only keep that same $10,000 in my "trading account".

FYI the XSPA price was due to a 3-1 reverse split, not a huge gain in price.

Last edited: