No forums found...

Site Related

Iowa State

College Sports

General - Non ISU

CF Archive

Install the app

Two-thirds of millennials have nothing saved for retirement

- Thread starter JP4CY

- Start date

No forums found...

Site Related

Iowa State

College Sports

General - Non ISU

CF Archive

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

With Millennials not getting married, buying cars or buying homes--it will be interesting how this plays out in the next 10-20 years

It's not that millenials will never marry or buy a house...a number of them are simply delaying these for a variety of reasons.

Getting married would be a really smart financial move for me, potentially doubling income and not doubling expenses. Prolly the easiest financial move I could make in the next 2 years.

You sure about that?

You sure about that?

Yes he's sure. It will quadruple his expenses, not double.

It's not that millenials will never marry or buy a house...a number of them are simply delaying these for a variety of reasons.

Always said I wanted a trophy wife after mine gets too old, if these mils aren't getting married it may mean I can stop scourering these Ukrainian bride ads.

Serious question, why do you want your house to gain in value? Do you plan to move when you retire? I have my house listed at what we paid to build it. No updates or improvements. My house is about assessed for this and I wish it was assessed for 10k so I wouldn't have to pay so much in stinking property taxes. I will most likely move when my last kid graduates, figure I will take what I get to get out of this high tax town.

Absolutely I plan to move when I retire. If not to a warmer state like Florida or Arizona, at least to a smaller house likely out of the city. I don't anticipate needing or wanting a 3 bed/3 bath 2 story + basement house right by good schools at that point.

Our house is currently accessed at about 80% of what it would sell for, and I'm perfectly fine with that!

How is this any different than the plan I presented a few pages ago? The only difference is one of my million would not be in retirement accounts.

I thought your plan was in addition to retirement savings? So I thought yours would be an additional million on top of those 2 - not a part of those 2. That's a lot more reasonable if that's what you were meaning.

Getting married would be a really smart financial move for me, potentially doubling income and not doubling expenses. Prolly the easiest financial move I could make in the next 2 years.

the other dudes joke but between getting married young and having minimal college debt, this really helped DH and I. Sure, groceries and utilities went up, but not double. And not paying two separate rents for that time frame was something that allowed me to start dumping money at my loans after he moved in and got a job.

the other dudes joke but between getting married young and having minimal college debt, this really helped DH and I. Sure, groceries and utilities went up, but not double. And not paying two separate rents for that time frame was something that allowed me to start dumping money at my loans after he moved in and got a job.

In all honesty, for most men I know marriage more than doubled their expenses. That is before kids came along. I know I could live on probably a third of what we spend without factoring kids. I know I would have a much simpler house, would eat out less (truthfully), furnishings in the house would be lower budget. Decorations, vehicles (I make sure the wife has nicer more dependable vehicles). Even things like I never used AC when single to now being 75 during summer. I buy generics, my wife goes name brand. I don’t need to paint the house every 3-4 years.

It IS a good financial move until your wife wants a baby. And then the prudent thing to do is join a country club and crash on their locker room couch every night.

In all honesty, for most men I know marriage more than doubled their expenses. That is before kids came along. I know I could live on probably a third of what we spend without factoring kids. I know I would have a much simpler house, would eat out less (truthfully), furnishings in the house would be lower budget. Decorations, vehicles (I make sure the wife has nicer more dependable vehicles). Even things like I never used AC when single to now being 75 during summer. I buy generics, my wife goes name brand. I don’t need to paint the house every 3-4 years.

Obviously who you pick as a spouse and your combined views on how to handle finances impacts this.

I like to drop in from time to time. Vote for clonecones on mafia. Drop some wisdom. Do general batman stuff. Like I do.Why are you back?

the other dudes joke but between getting married young and having minimal college debt, this really helped DH and I. Sure, groceries and utilities went up, but not double.

I know I made joke about that, but honestly my girlfriend at the time, now wife, was probably my saving grace after college since we moved in together and she was the only one who had a full time job.

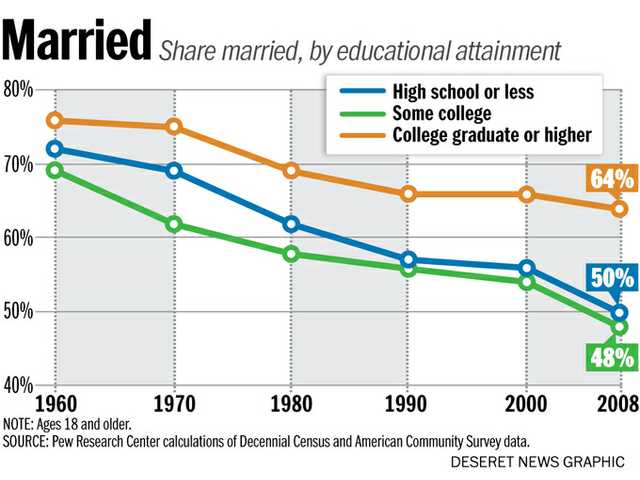

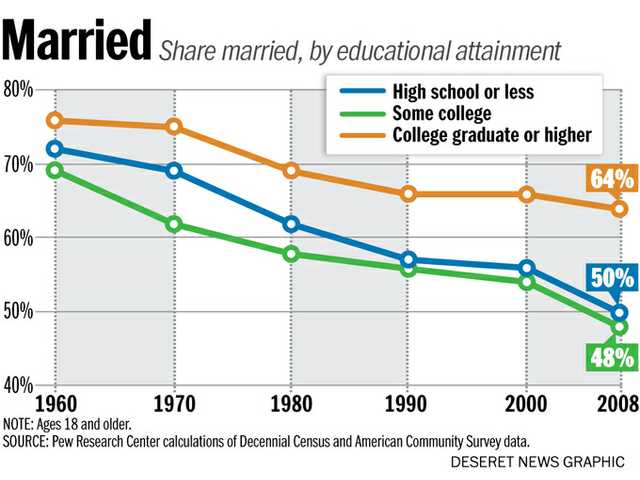

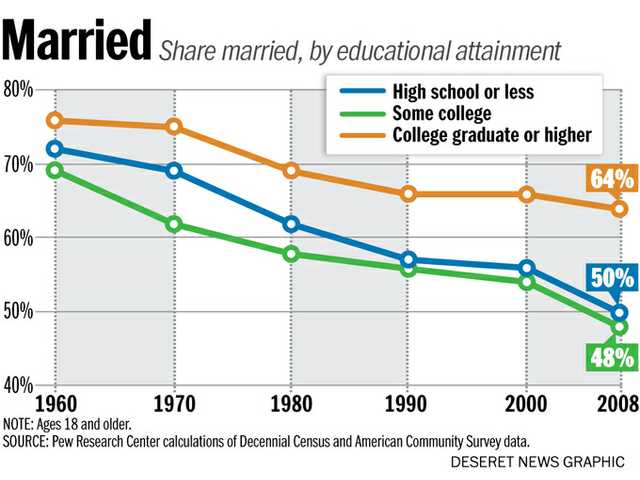

A friendly PSA to remind or show people that marriage is becoming a "luxury good" -- something mostly enjoyed by the educated and wealthy in our society...

It used to be a relatively cosmopolitan institution, but now it is one mostly (not entirely, you can read the graphic) just another benefit of a college education.

It used to be a relatively cosmopolitan institution, but now it is one mostly (not entirely, you can read the graphic) just another benefit of a college education.

A friendly PSA to remind or show people that marriage is becoming a "luxury good" -- something mostly enjoyed by the educated and wealthy in our society...

It used to be a relatively cosmopolitan institution, but now it is one mostly (not entirely, you can read the graphic) just another benefit of a college education.

It’s no so much a “luxury good” as much as it is culturally normative for college graduates.

Obviously who you pick as a spouse and your combined views on how to handle finances impacts this.

Marry a girl who grew up on meager means, and she won't bankrupt you!

It’s no so much a “luxury good” as much as it is culturally normative for college graduates.

I was using luxury good in the very technical sense -- something that is more likely to be consumed the more income or wealth that you have.

Marriage, if you see matrimony as a "consumption" item or decision (such as you would see any other action) definitely falls into that category.

Economic and social norms are often impossible to unwind from each other. We are saying the same things but coming at them with different terminology.

Obviously who you pick as a spouse and your combined views on how to handle finances impacts this.

a woman