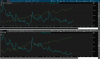

the greatest bearish divergence ever observed is now set in place

blue - imp volatility

lower - rsi

red lines - current divergence

purple lines - early 2020 divergence

light blue lines - 2018 divergence

never has a more bearish divergence been present since the founding of the vix or its predecessor the vox (which is available on most platforms back to 87)

tops in 29 and 08 and 18 and 87 were around labor day

00 crash in march, came back to double top in july/october the one exception to the labor day rule

i dont know if a crash is coming or what would cause it, i do know that the greatest bearish divergence ever observed on the s&p is now present on the daily, weekly and monthly charts